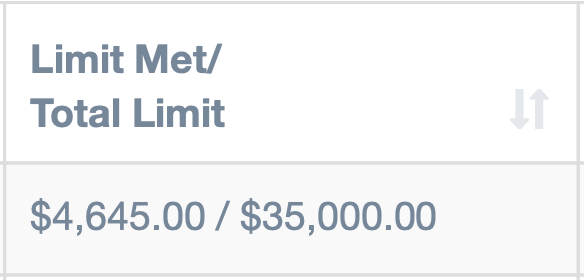

In the Case List, the Limit Met is the sum of providers’ bills to-date. The Total Limit is per person (not per accident). If you see “N/A” in the area where Total Limit should be, you haven’t entered the information necessary for it to be calculated.

In the “Insurance” tab, in “Defendant’s Insurance Information”, click the “Add Def. Info” button or click the pencil icon.

Select the insurance provider from the dropdown or select “Uninsured”.

If the defendant is insured, enter the “Bodily Injury Coverage Per Person”. Otherwise “Total Limit” won’t calculate.

Uninsured motorist (UIM) coverage protects plaintiffs who are in an accident with an at-fault driver who doesn’t have insurance.

Underinsured motorist (UM) coverage kicks in when plaintiff is in an accident with an at-fault driver whose liability limits are too low to cover the damage or medical expenses. The at-fault driver’s Bodily Injury Coverage will pay for all damages up to the policy limits (Per Person and Per Accident), and then plaintiff’s UM coverage will cover the excess amount up to the limits.

In the “Insurance” tab, in “Plaintiff’s Insurance Information”, click the “Add Plt. Info” button or click the pencil icon.

If the plaintiff is insured, enter “UM Coverage Per Person” and/or “UIM Coverage Per Person” in the Plaintiff Insurance Info section. If your state combines UM/UIM, enter the coverage amount in either field. Otherwise “Total Limit” won’t calculate.

If plaintiff is insured, then UM/UIM Type must be selected for “Total Limit” to calculate.

Stacked — Let’s say the plaintiff’s UM Coverage Per Person and UIM Coverage Per Person adds up to $25,000. The at-fault driver has $25,000 in Bodily Injury Coverage. If the policy type is “Stacked”, $25,000 for UM/UIM + the at-fault driver’s $25,000 = $50,000 “Total Limit” towards bodily injury losses.

Unstacked — This is also called “traditional” coverage. You can turn to this coverage only if the plaintiff’s UM/UIM coverage exceeds the at-fault driver’s bodily injury coverage. If so, the amount of UM/UIM coverage available to you is reduced, or “offset”.

Let’s see how the same coverage from the previous example would result in a different “Total Limit” if the policy type was “Unstacked.” $25,000 for UM/UIM – the at-fault driver’s $25,000 = $0 accessible from UM/UIM. “Total Limit” towards bodily injury losses is $25,000. The result: Plaintiff has $0 available in UM/UIM coverage because this product only guaranteed that the at-fault driver would have coverage for $25,000 of damage. Even if the plaintiff’s bodily injury losses exceed $25,000, you would not be able to use their UM/UIM policy.

However, if the plaintiff had $100,000 in unstacked UM/UIM coverage, $100,000 for UM/UIM – the at-fault driver’s $25,000 = $75,000 available from UM/UIM. “Total Limit” towards bodily injury losses is $100,000.

If the at-fault driver was uninsured, unidentifiable (e.g hit-and-run) or if their bodily injury coverage had been reduced or exhausted by other claims, the full amount of $100,000 UM/UIM would be available to you.